ICBC Basic Autoplan

ICBC Basic auto insurance ensures that you and those who own and operate a motor vehicle in BC are protected with a basic level of coverage. In British Columbia, you are required to carry a minimum of $200,000 Basic Third Party Liability coverage.

Basic Third-Party Liability (TPL) coverage may respond when an insured customer is responsible for an accident. Each jurisdiction has its own lawsuit regulations, therefore, depending on where an accident occurs, Basic Third-Party Liability coverage may or may not respond.

When an accident occurs in a jurisdiction outside of BC where lawsuits for vehicle accidents are permitter, the non-responsible third party could make a claim against you for their injuries, vehicle damage, property damage, or other losses. In these situations, your Basic Third-Party Liability may respond and covers up to $200,000 for these costs.

Effective May 1, 2021, under Enhanced Care, there are some situations in BC where Basic Third-Party Liability responds. Some examples:

- Damage to non-vehicle property belonging to a third party, such as buildings, fences, bicycles, and

- Damage to contents or cargo carried in or on a third party’s vehicle

Many people in BC choose to extend their Third-Party Liability coverage for additional protection. For passenger vehicles you can select an increase of up to $5,000,000.

For more information, please follow the link to a PDF TPL discussion.

https://www.autoplan.icbc.com/News/Documents/TPL-and-TPE-Discussion-Guide.pdf

Enhanced Accident Benefits (AEB)

Enhanced Accident Benefits are included in your Basic TPL coverage. These benefits protect you, your passengers and members of your household with medical costs, loss of wages, and more if you’re injured in a motor vehicle accident, even if you are found at-fault. Enhanced Accident benefits provide care and recovery benefits with no overall limit. This could include costs like chiropractic treatments, dental care, medication, physiotherapy, home support and more.

And, if you’re unable to work due to an injury from a crash, your Enhanced Accident Benefits will provide income replacement benefits based on 90 per cent of your net income, up to a maximum of $113,000 gross annual income. If your gross yearly earnings are more than $113,000 per year, Income Top-Up coverage is available for purchase.

Income Top-Up

ICBC’s Income Top-Up is optional coverage that provides additional income replacement support to top up the wage loss benefits provided from enhanced care.

For more information on ICBC’s Income Top-Up, please follow the link to ICBC’s Income Top-Up Brochure.

https://www.icbc.com/assets/en/69QqwUpVW4H39g6EvHD35Z/income-top-up-brochure.pdf

Basic Underinsured Motorist Protection

Basic Underinsured Motorist Protection (UMP) covers you and members of your household for claims of up to $1 million per insured person in rare situations where you or members of your household are injured in a crash, but are not entitled to Enhanced Accident Benefits, and the responsible driver lacks sufficient coverage to pay damages awarded in a claim.

Hit & Run

Hit and Run coverage covers up to $200,000 of repair costs when your vehicle is hit by an unidentified driver in BC. If you don’t have hit and run coverage or collision coverage, you’ll be responsible for repair costs if your vehicle is damaged in a hit and run incident.

Injured in a hit and run? Enhanced Accident Benefits provide access to all the medical and rehabilitation care you need if you’re injured in a crash- with no overall limit to the coverage available.

Inverse Liability Coverage

This protects you in parts of Canada or the U.S. where local laws don’t let you claim against the person who caused your crash. Your vehicle repair costs are covered up to 100 per cent (less if you were partly responsible for the crash). For example, if you were 25 per cent responsible, you’ll receive 75 per cent of the cost of repairing your car.

Basic Vehicle Damage Coverage

Up to $200,000 of Basic Vehicle Damage coverage is included in your Basic insurance and covers repairs when the other driver is responsible – instead of recovering the cost of your vehicle repairs from the insurance policy of the driver responsible, your own insurance will cover you.

If your vehicle is worth over $200,000, talk to us about coverage options.

If you are responsible for a crash, your optional Collision coverage will pay for the repairs to your vehicle. If you don’t have Collision coverage, you are responsible for the repairs.

What could affect your Basic Autoplan Coverage

Here are some things you can do to help ensure your coverage stays valid:

- Your vehicle must be rated correctly. It’s important that you tell your broker how you use your vehicle (that is, your rate class), and who will be driving it most of the time.

- If you have a claim, provide correct information.

- Never drive if your driver’s licence is expired or suspended, and make sure that anyone who drives your vehicle has a valid driver’s licence.

- Don’t drive when you’re impaired by alcohol or drugs.

- Be aware your Basic Autoplan insurance only covers you in Canada and the U.S.

For more information on ICBC’s products and coverages, please follow the link to the ICBC website.

https://www.icbc.com/insurance/products-coverage

Unlisted Driver Protection

If an unlisted driver causes a crash in your car, you could face a financial consequence unless you have Unlisted Driver Protection.

If you’d like the flexibility to be able to lend your car occasionally to a driver not listed on your policy, Unlisted Driver Protection can provide peace of mind. It protects you from the Unlisted Driver Accident Premium, which is a financial consequence if an occasional driver, not listed on your policy, causes a crash in your car.

Unlisted Driver Protection can apply to Basic and Optional insurance.

Here are some scenarios where Unlisted Driver Protection would protect you in the event of a crash:

- A friend is visiting from another province and uses your car to run an errand

- Your neighbour’s car won’t start and you let them borrow your car to pick up their child from school

- You aren’t feeling well and a colleague or classmate who lives nearby is driving you home in your car

Before you lend your car to an unlisted driver: Ask the driver to show you that they’re in possession of a valid licence. If they don’t have one and cause a crash in your car, you could face a financial consequence. A driver’s licence is not valid if it’s expired, suspended, cancelled or prohibited.

Drivers you should list:

Some types of drivers are excluded from Unlisted Driver Protection. Even if you have the coverage, you could face a financial consequence if a crash is caused by an unlisted driver who is:

- A member of the household of the registered owner or principal driver, meaning anyone who ordinarily lives with them. This can be a spouse, family member, friend or roommate, or even a student who is home for holidays or a school break.

- An employee of the registered owner or principal driver, who is working full-time, part-time or temporarily

- A regular driver of any of your vehicles

- Responsible for a previous crash in your vehicle and is driving any of your vehicles

If you’re not sure if you need to list a driver, contact us to discuss further.

IMPORTANT: Don’t forget to list a member of your household or an employee who becomes a learner driver. Household members and employees who become learner drivers must be listed on your policy if they drive your vehicle or you could face the Unlisted Driver Accident Premium.

What does Unlisted Driver Protection Cost?

As long as unlisted drivers do not cause crashes in any of your cards, this protection will be free. However, if an unlisted driver does cause a crash in your car and you want to continue to have this protection, the you’ll need to pay for it. This is in addition to the financial consequence you may have to pay. If more unlisted driver crashes occur, the cost of this protection will continue to increase.

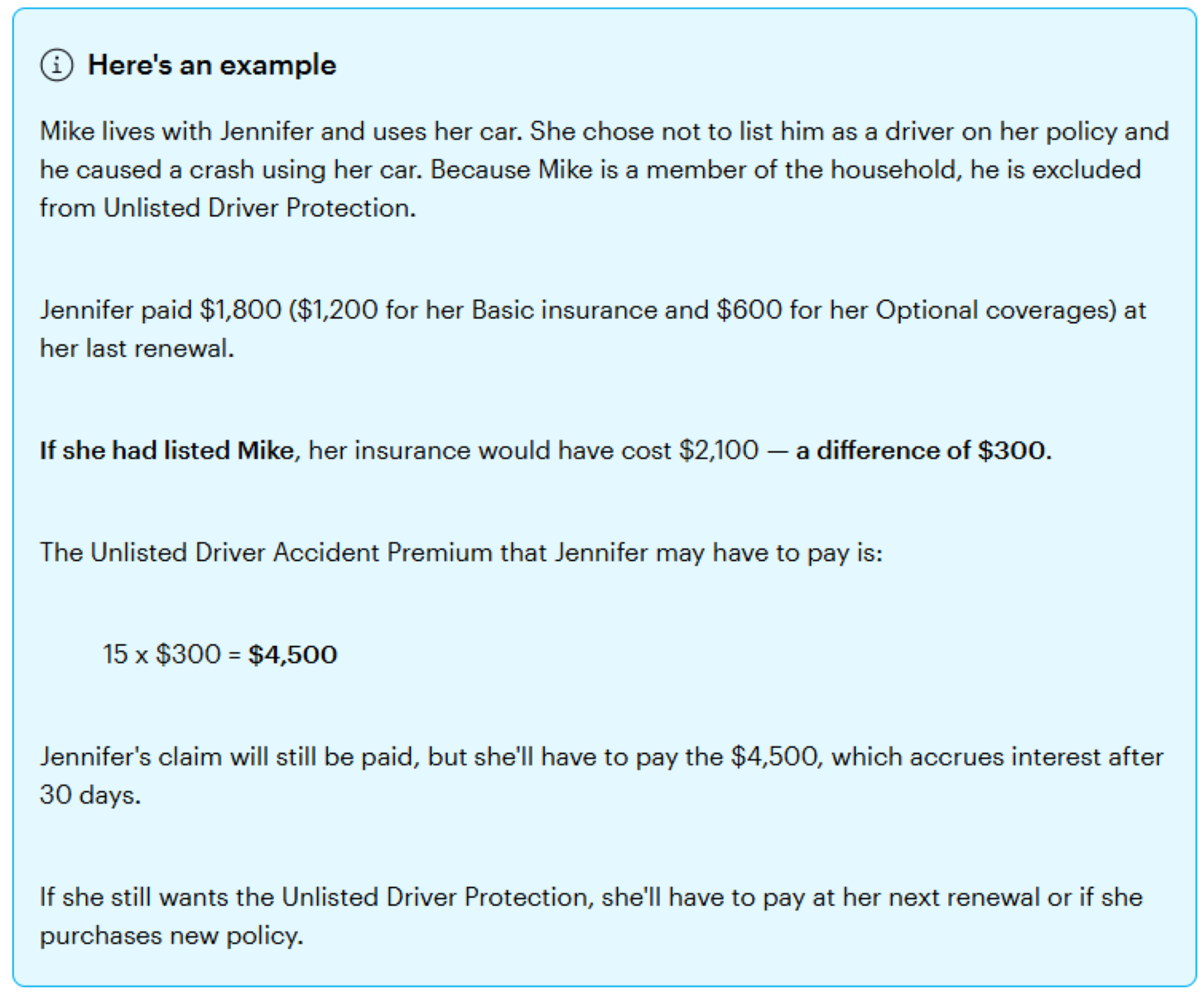

What is the financial consequence if an unlisted driver causes a crash in my car?

If an unlisted driver causes a crash in your car, you could face a financial consequence, called the Unlisted Driver Accident Premium. This will depend on a number of factors, such as where they are licensed and driving experience and crash history.

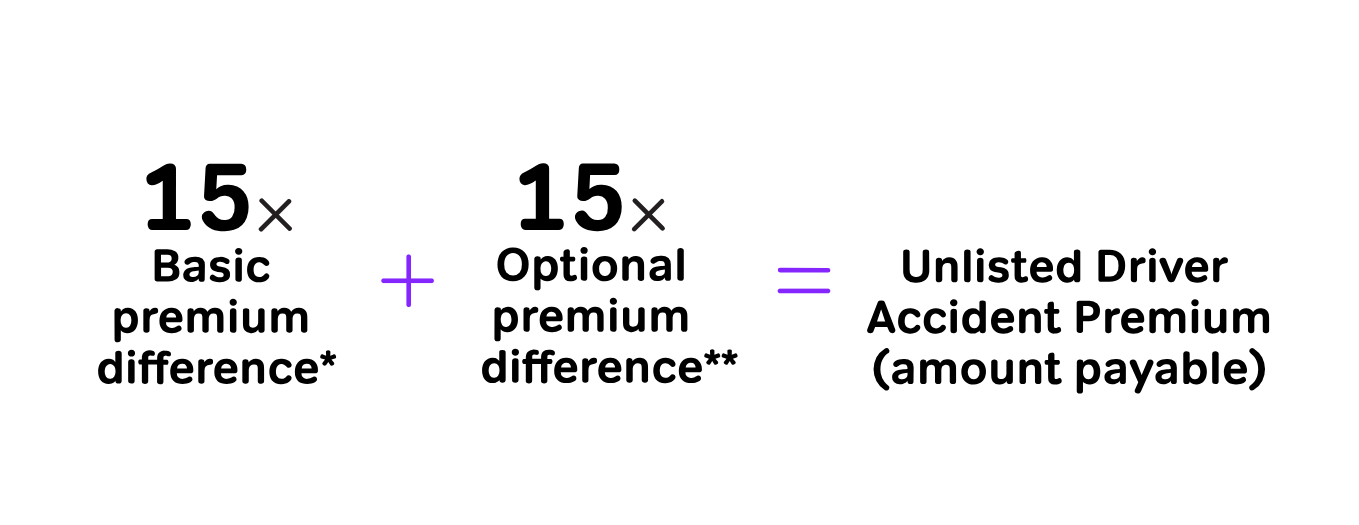

The Unlisted Driver Accident Premium will look at how much Basic and Optional premiums would have been, had you listed the driver who caused the crash. If there is a difference in premium, the financial consequence is 15 times both the Basic premium difference* and the Optional premium difference**.

*to a maximum of $5,000

**to a maximum of two time the Optional premium

If there is no difference in premium, there would be no consequence to pay. However, you will need to pay for Unlisted Driver Protection at your next renewal, if you want this protection.

Importing a Vehicle to BC

Whether you are moving to BC from out of province, or purchasing a vehicle from the United States, Irwin & Billings is here to help.

If you are a BC resident who will be bringing a vehicle from out of province into BC, please contact us for more information in obtaining a binder of insurance so the vehicle is covered while you drive to BC.

When importing a vehicle from the United States, the following documents will be required to bring to our office:

- Vehicle Import Form 1 with two stamps from Canada Border Services Agency (CBSA)

- CBSA document B15, or B3 or B4

- The vehicle’s original Certificate of Title or Certificate of Origin

- The original bill of sale, and

- A “passed” inspection report, signed by the inspector, from a designated inspection facility. (Not required for motorcycles or trailers)

Please also bring the vehicle to our office as we will need to verify the VIN number.

When importing a vehicle to BC from another province in Canada, the following documents will be required to bring to our office:

- The vehicle’s original registration or New Vehicle Information Statement

- The original bill of sale

- A “passed” inspection report, signed by the inspector, from a designated inspection facility (not required for motorcycles or trailers)

For more detailed information on importing vehicles into BC, please follow the link to the ICBC website. http://www.icbc.com/vehicle-registration/buy-vehicle/Pages/Importing-a-vehicle-into-B-C.aspx

Collector Vehicle Information

If you have a vehicle that is older than 15 years, in great condition, and is not your primary vehicle, you may be eligible for Collector Status.

To qualify, your vehicle must be:

- 25 years or older, or

- at least 15 years old and of no more than 1,500 of that make and model (not edition) produced worldwide by the manufacturer for that model year

- at least 15 years old, where the manufacturer that owns the “trademark” or “make” of that vehicle has ceased manufacturing vehicles of any kind for at least the last five years, or

Follow the link below for further information, and to fill out an application online.

Collector vehicles (icbc.com)

If you have a vehicle registered as a 1974 model or older that has had major components replaced or altered, you’ll need to register it as a modified vehicle. It may also qualify as a modified collector vehicle.

Follow the link below for further information, and to fill out an application online.

Recent Posts

Our Clients Say

Insurance customer 1

They are very helpful and they made sure that I got the best rate for my money. It was quick, easy, I was in and out the door. Everything went as expected.

testimonial 2

They are very experienced in what they do they are very knowledgable.

testimonial 3

She seemed to be well-informed. This is a family business that we've gone to for many years. They've always treated us very well. Their staff seems to be well-trained in procedures.

testimonial 4

They did the comparison to both of my vehicles for the supplementary insurance, and let me know the price differences so I could make a decision quickly and easily.

testimonial 5

They're knowledgeable. They ask the right questions and they ensure we have the policies that suit our needs best.

testimonial 6

They went above and beyond my expectations and reduced my insurance costs and that made me very happy.

testimonial 7

They got me a quote and then asked me if I would like to compare it to private insurance, saying it might be cheaper. It was, and it came with more perks, so I went with the ICBC base and then private insurance.

testimonial 8

The broker was very polite she answered all my questions she helped me to make a choice of the best insurance policy for me. I have been going to this office for years and the atmosphere is very nice. They were friendly and helpful and provided prompt service.